Top Active VC Funds Heavily Investing in Tier 2/3 India

Why Smart Capital is Moving from Saturated Metros to Tier 2/3 Hubs

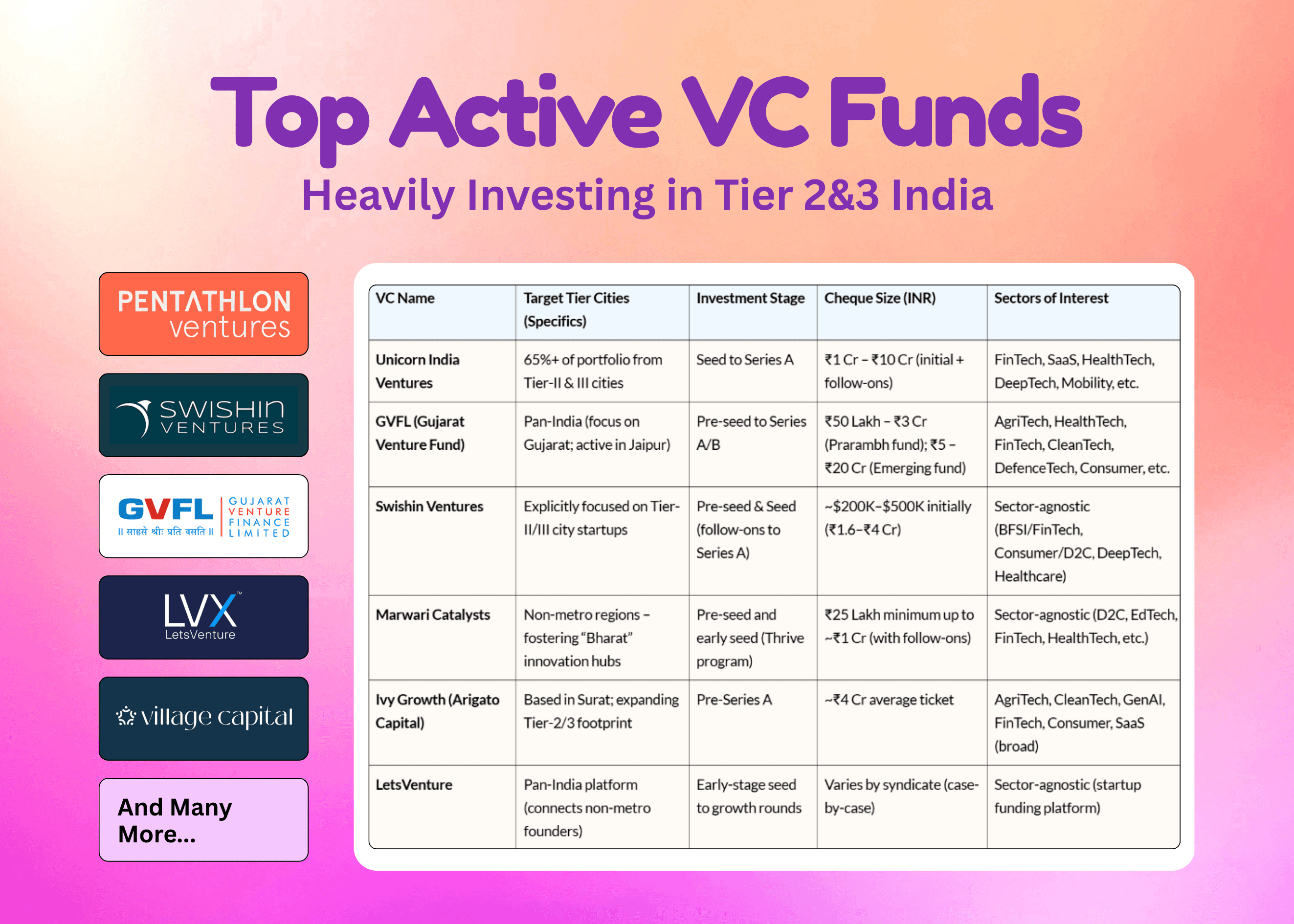

As 2025 comes to a close, a massive shift is visible in the venture ecosystem: innovation is decentralized. While 90% of media coverage focuses on Bangalore, Mumbai and many other Tier 1 cities, our data shows over $500 Million in dry powder is specifically allocated for Bharat, the founders building in Jaipur, Surat, Kochi, and Indore. This isn't just impact capital; it's high-growth VC money chasing the next Lenskart or CarDekho. We've curated the definitive list of 30+ Active VC Funds and Angel Networks that don't just accept regional pitches, they actively hunt for them.

Early-Stage VC Funds for Tier-2/3 India

VC Name | Target Tier Cities (Specifics) | Investment Stage | Cheque Size (INR) | Sectors of Interest |

|---|---|---|---|---|

Unicorn India Ventures | 65%+ of portfolio from Tier-II & III cities | Seed to Series A | ₹1 Cr – ₹10 Cr (initial + follow-ons) | FinTech, SaaS, HealthTech, DeepTech, Mobility, etc. |

GVFL (Gujarat Venture Fund) | Pan-India (focus on Gujarat; active in Jaipur) | Pre-seed to Series A/B | ₹50 Lakh – ₹3 Cr (Prarambh fund); ₹5 – ₹20 Cr (Emerging fund) | AgriTech, HealthTech, FinTech, CleanTech, DefenceTech, Consumer, etc. |

Swishin Ventures | Explicitly focused on Tier-II/III city startups | Pre-seed & Seed (follow-ons to Series A) | ~$200K–$500K initially (₹1.6–₹4 Cr) | Sector-agnostic (BFSI/FinTech, Consumer/D2C, DeepTech, Healthcare) |

Ivy Growth (Arigato Capital) | Based in Surat; expanding Tier-2/3 footprint | Pre-Series A | ~₹4 Cr average ticket | AgriTech, CleanTech, GenAI, FinTech, Consumer, SaaS (broad) |

LetsVenture | Pan-India platform (connects non-metro founders) | Early-stage seed to growth rounds | Varies by syndicate (case-by-case) | Sector-agnostic (startup funding platform) |

JITO Angel Network | Nationwide angel network (40% members in Tier-2/3) | Early-stage (angel rounds) | Up to ₹12 Cr per startup | Sector-agnostic (with ethical exclusions: no alcohol, meat, leather) |

All In Capital (Elevator Pitch 2.0) | Targets founders from Tier-II/III cities via live pitch program | Early seed (valuations < ₹50 Cr) | ~₹5 Cr total pool (multiple startups; e.g. up to ₹2 Cr to a winner) | FinTech, SaaS, Consumer, HealthTech, AI, DeepTech (broad early-stage) |

Venture Catalysts | Active in 30+ Tier-2/3 cities (Ahmedabad, Lucknow, Jaipur, etc.) | Idea, Seed, and Series A (via funds) | ₹4 – 16 Cr per deal (approx $500k–$2M) | Sector-agnostic (FinTech, Health, AgriTech, Consumer, AI, EV, etc.) |

Anicut Capital | Focus on Tier-2 hubs (Erode, Coimbatore, Kochi, etc.) | Seed to Series B (also Venture Debt) | ₹3–5 Cr (Seed equity); ₹15–30 Cr (Series A/B) | FinTech, Consumer, EV, DeepTech, Logistics, SaaS |

100X.VC | Pan-India (incl. Jammu, Kochi, Bhopal, Lucknow, etc.) | Pre-Seed (first institutional check) | ₹1.25 Cr per startup (via iSAFE note) | Tech-first, sector-agnostic (Consumer, SaaS, FinTech, DeepTech) |

Indian Angel Network (IAN) + IAN Fund | Network in Tier-2 hubs (Jaipur, Chandigarh, Indore, Kochi, Guwahati) | Seed rounds (IAN) & Series A via IAN Fund | ₹50 Lakhs – ₹10 Cr per startup | Technology, Healthcare, Education, FinTech, Travel, AgriTech |

Inflection Point Ventures (IPV) | Active in Tier-2 cities (Jaipur, Chandigarh, Calicut, etc.) | Seed & Pre-Series A | ~₹2 – 4 Cr average deal size | Consumer Internet, D2C, SaaS, EdTech, FinTech |

We Founder Circle (WFC) | Chapters in Jaipur, Pune, Lucknow, Surat, Guwahati | Pre-Seed and Seed rounds | ₹1 – 3 Cr per startup (pooled angels ₹5–25L each) | Consumer Tech, FinTech, E-commerce, B2B SaaS, DeepTech |

Mumbai Angels Network | Presence in Pune, Jaipur, Kolkata, Vizag, Chandigarh | Seed/Angel rounds | ₹50 Lakh – ₹3 Cr per deal | Tech-enabled businesses across sectors (sector-agnostic) |

CIIE.CO (& Bharat Inclusion Seed Fund) | Pan-India (incl. rural & Tier-2/3 startups) | Pre-Seed to early Series A | ₹50L–₹2 Cr (equity); ₹10–25L (grants) | FinTech, AgriTech, HealthTech, CleanTech, GovTech |

Ankur Capital | Small towns, rural and Tier-3 city focus | Seed and early Series A | ₹1 – 5 Cr | AgriTech, Education, Health, FinTech, Livelihoods |

Villgro Innovations | Deep rural India and small towns | Pre-Seed grants & Seed equity | ₹10 Lakh – ₹1 Cr per startup | Agriculture, Clean Energy, Healthcare, Education |

Aavishkaar Capital | Active beyond metros (Jaipur, Nagpur, Bhubaneswar, rural) | Series A to C growth rounds | ₹15 – 40 Cr (approximately $2–5M) | Financial Inclusion, Agri & Food, Sustainability, Health, Education |

Social Alpha (FISE) | Northeast, hill states, rural India focus | Pre-Seed (grants) & Seed (equity) | ₹20–50L grants; ₹50L–₹3 Cr equity | ClimateTech, AgriTech, Health, Waste, Water, Sanitation |

Artha Venture Fund | Tier-2 cities (Nagpur, Jaipur, Surat, etc.) | Seed to Series A | ₹3 – 8 Cr per startup | D2C Brands, FinTech, B2B SaaS, Mass-market Tech |

Unitus Ventures (Unitus Seed Fund) | Pan-India with “Bharat-first” focus (e.g. Hubli, Jaipur) | Seed and early Series A | ₹1.2 – 4 Cr per startup | EdTech, FinTech, JobTech, Agri/Food, Healthcare |

Pentathlon Ventures | Pune-based; building B2B SaaS ecosystem in Tier-2 hubs | Seed and Pre-Series A (B2B SaaS focus) | ₹2 – 8 Cr ($250K–$1M) | B2B SaaS, Enterprise Software, DeepTech solutions |

Axilor Ventures | Accelerator open to Tier-2/3 founders (e.g. Madurai, Bhagalpur) | Pre-Seed (Accel.) to Seed (fund) | ₹25–50L (accelerator); up to ₹3–5 Cr (seed fund) | Consumer, Enterprise, FinTech, Supply Chain, DeepTech |

Blume Ventures | “Bharat-focused” startups (e.g. Manipal, Pune) | Seed to Series A | ₹1 – 7 Cr typical check | D2C, FinTech, Marketplaces, SME Tech, SaaS |

Antler India | Backs solo founders in Coimbatore, Bhubaneswar, Kochi, etc. | Day 0/Ideation to Pre-Seed | ₹1 – 1.2 Cr ( ~$100–150K ) | DeepTech, FinTech, Web3, SaaS, D2C (scalable tech) |

Village Capital | Remote accelerator for Tier-2 city founders (India-wide) | Pre-Seed & Seed (through accelerator) | ~$50K equity (approx ₹40L) per startup | FinTech, EdTech, Sustainable Agri, Health, Climate |

Omidyar Network India | 50%+ of portfolio based outside top-3 metros | Seed to Series B | ₹80 L – ₹40+ Cr ($100K–$5M+) | Inclusive FinTech, CivicTech, EdTech, GovTech, AgriTech |

Acumen India (Acumen Fund) | Deep rural focus (Rajasthan, UP, Bihar, NE India) | Seed to Early Growth | ₹80 L – ₹4 Cr (typical $100–500K), up to ~₹8 Cr | Energy, Livelihoods, Healthcare, Water, Workforce |

Quona Capital | Tier-2 financial hubs (Ahmedabad, Jaipur, Chennai, etc.) | Series A to C (Growth stage) | ₹25 – 80 Cr ($3–10M) | FinTech, InsurTech, LendingTech, PropTech |

Arkam Ventures | Focus on “Middle India” startups (beyond top metros) | Early-stage (Seed to Series A) | ₹3 – 15 Cr (typical check in target deals) | Middle-India digitization (finserv, agri/food, etc.) and SaaS |

Lok Capital | Primarily Tier-2/3 towns and rural markets (impact focus) | Early-Growth (pre-Series A to Series B) | ₹10 – 30 Cr initial; follow-ons up to ~₹50 Cr | Financial inclusion (fintech), health-tech, agri/food, climate solutions |

NABVENTURES (NABARD Fund) | Pan-India with emphasis on agri/rural startups | Early to mid-stage (Seed to Series A/B) | ₹3 – 10 Cr (est.) for seed; larger in growth rounds | AgriTech, Food, Rural businesses, agri-financial services |

ah! Ventures | Pan-India angel platform (startups in Tier-2 cities like Lucknow, etc.) | Seed & early growth (angel rounds) | Up to ~$1M (₹8 Cr) per startup via syndication | Sector-agnostic (largest curated angel network platform) |

SucSEED Indovation Fund | Pan-India, tech startups solving mass-market “Bharat” needs | Seed to Pre-Series A | ~₹1 – 2 Cr (typical first check) | EdTech, FinTech, HealthTech, Enterprise SaaS, Security/RegTech |

Orios Venture Partners | Targets the “next 300 million” consumers beyond metros | Seed and Pre-Series A | ₹4 – 12 Cr (₹~1–3M) per round | Mass-market tech (financial services, consumer apps, B2B marketplaces, etc.) |

North East Venture Fund | Startups based in North-East India (NER states) | Seed and Early-stage | ₹50 Lakh – ₹3 Cr (typical range) | Healthcare, Biotech, Clean Energy, tourism and more (regional priorities) |

Elevar Equity | Underserved emerging markets (low-income communities) | Early-growth (Pre-Series A to Series B) | ₹5 – 20 Cr (approx $0.5M–$2.5M) | Essential services for underserved customers – fintech, agri, healthcare, etc. |

Omnivore | Agriculture & rural economy startups across India (many in Tier-3) | Seed and Series A | $1 – 5 M (₹8 – ₹40 Cr) initial checks | AgriTech, Food & Agri life-sciences, Rural FinTech, Climate-smart agriculture |

Sources: Verified and updated from fund websites, news releases, and reports as of Dec 2025. All funds listed have an active investment presence in India’s Tier-2 and Tier-3 startup ecosystems.

Your Location is No Longer Your Liability. It’s Your Moat.

This list proves one thing: you don't need a Bangalore zip code to raise institutional capital. The smartest investors in 2025 know that lower burn rates, higher retention, and untapped local markets give Tier 2/3 founders a massive structural advantage. Use this table to filter investors by your city and sector, and pitch them on your Bharat advantage, capital efficiency and deep market understanding, rather than trying to look like a Silicon Valley clone.

Are you a Fund or Angel Network actively investing in Bharat? We are constantly updating this Goldmine resource to ensure it remains the single source of truth for regional founders. If you want high-quality, pre-filtered deal flow from India's emerging hubs, click here to submit your fund for review. At Backrr, our mission is to bridge the gap between talent and capital, no matter the pincode. Use our platform to manage your pipeline and close your next round with confidence.