The Only Global Accelerator List Indian Seed+ Founders Need

Do You Really Need an Accelerator? Let’s Do the Math

Is giving up 7% of your company to YC or Techstars still worth it in 2026? The answer depends on your sector and stage. We broke down the math for every major accelerator, comparing check sizes, MFN clauses, and hidden perks like free office space or wet labs. Stop guessing and start negotiating. Here is the verified database of high-signal accelerators for Indian Seed+ founders.

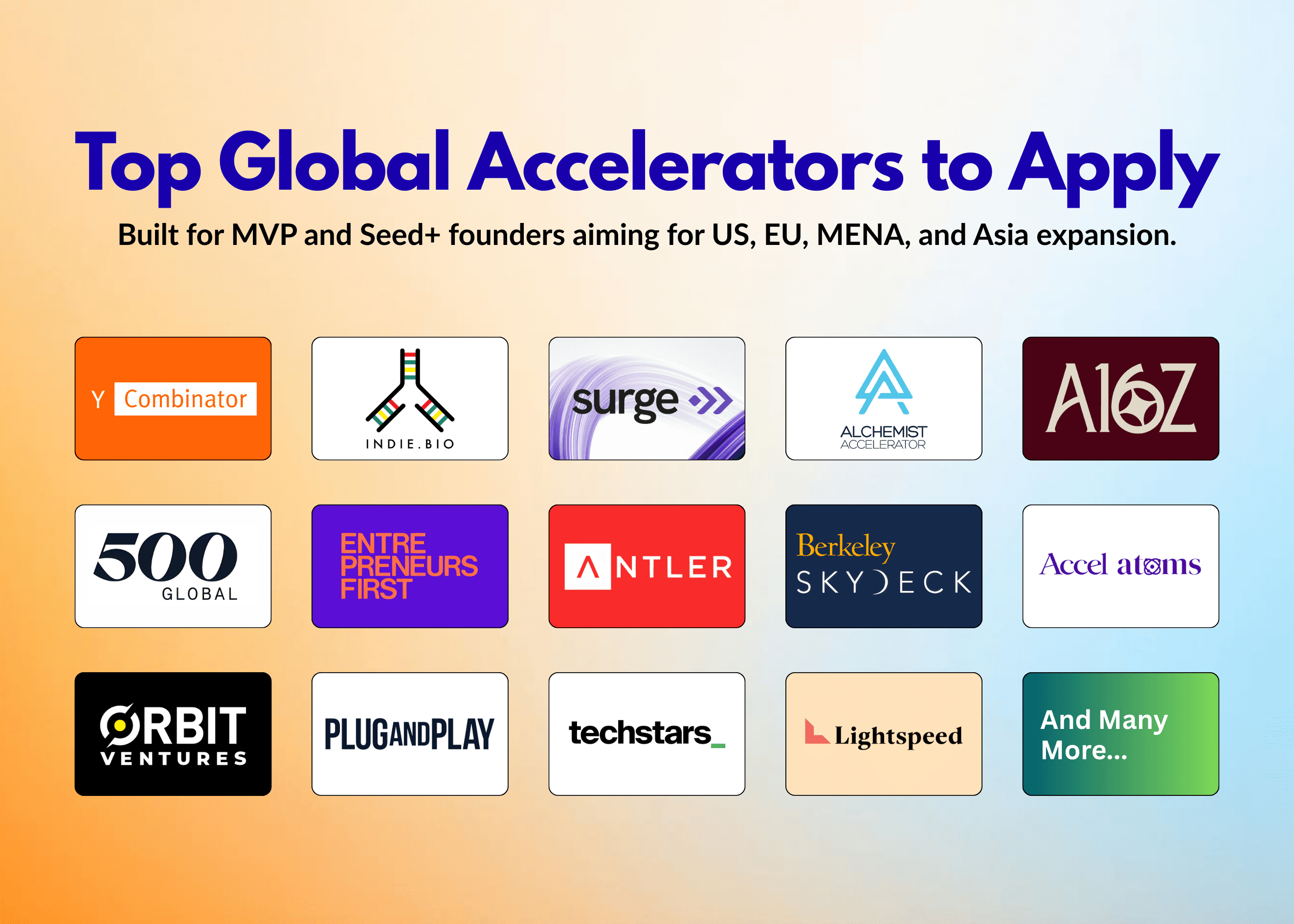

Global Accelerator List

Accelerator Name & Location | Sector Focus | What the Startup Must Give | Perks (Monetary & Non-Monetary) | How to Approach |

|---|---|---|---|---|

100Unicorns - Bangalore, India, hybrid | Generalist: AI, consumer, fintech, SaaS, deeptech, mobility, healthtech, ecommerce, edtech | 5–12% equity via SAFE or priced round (stage-dependent) | $100K–$500K first cheques, $1–2M follow-ons, 157+ portfolio companies, Demo Day, PR/brand support | Highlight revenue, capital efficiency, and clear path to Series A. |

100X.VC - Bengaluru, hybrid | DeepTech, SaaS, AI/ML, FinTech, Health | 8-10% equity via iSAFE notes | ₹50L-₹1.5Cr funding, VC network access, monthly sessions with 50+ investors | Showcase hard tech and AI differentiation using founder-friendly iSAFE notes. |

500 Global - Mountain View/Global, hybrid | Generalist, SaaS, Consumer, FinTech | 6% equity for $150K | $150K funding, growth marketing expertise, distribution focus | Emphasize growth metrics and distribution-first strategy for international scaling. |

Accel Atoms - Global, online | AI, devtools, SaaS, Bharat-first, deep tech | Terms vary; shared post-selection | Founder-first support, Accel global network, India-origin founder focus, GTM guidance | Submit live product with metrics, demonstrating high shipping velocity. |

Alchemist Accelerator - US hubs/hybrid | Enterprise: B2B SaaS, AI infra, cybersecurity, fintech | Equity varies; often SAFE-based (terms post-acceptance) | Enterprise customer access, heavy GTM mentoring, investor network, Flagship cohort start Jan 22, 2026 | Provide enterprise proof via target accounts, pilot LOIs, and velocity. |

Andreessen Horowitz Speedrun - San Francisco/hybrid | AI, fintech, crypto, enterprise, consumer (cohort theme varies) | Terms vary; a16z invests separately ($1M max per company) | Elite operator sessions, a16z platform support, strong US network, SR006 cohort Jan 26–Apr 12, 2026 | Reveal insider signals and sharp insights that competitors typically ignore. |

Antler - BLR/Mumbai, offline | Generalist, SaaS, FinTech, DeepTech | 8-10% equity for €100K-€200K | €100K-€200K funding, co-founder matching, global expansion in 45 countries | Apply solo for matching or detail expansion plans for international markets. |

Atal Centres (AIC) - 100+ locations, offline (Application Currently Not Open) | Generalist, AgriTech, HealthTech, Tech | 2-10% equity for seed funding | ₹10L-₹50L funding, physical infrastructure, sector-specific mentor access | Pitch prototype innovation within a sector-specific center showing geographic flexibility. |

AWS Activate - Global, online | Generalist, SaaS, AI, Infrastructure | 0% equity dilution | Up to $100K Credits, technical training, pathway to AWS partnerships | Use VC referrals for credits; focus on high-usage cloud scaling plans. |

Axilor Ventures - Bengaluru, offline | SaaS, FinTech, HealthTech, Enterprise, AI | 8-12% equity for 500K−750K | $500K funding, access to $300M follow-on fund, mentorship from ex-Flipkart founders | Pitch validated B2B SaaS emphasizing capital efficiency and no board seats. |

Berkeley SkyDeck - Berkeley, USA, hybrid | AI, deeptech, biohealth, climate (broad) | 7.5% equity for $200K (post-money SAFE) | $200K funding, UC labs access, 850+ investor Demo Day, follow-on participation potential | Outline technical moat and GTM in six bullets; ensure Berkeley-grade clarity. |

Better Tomorrow - Global, online (Application Currently Not Open) | Climate, Healthcare, Education, FinTech | 10% equity plus MFN SAFE | $500K funding, ESG-rated fund support, impact investor network access | Lead with ESG-driven narratives on healthcare or inclusive FinTech foundations. |

Blume Ventures Seed - Mumbai/BLR, offline | Generalist, Rural Tech, SaaS, Climate | 10-15% equity for ₹50L-₹2Cr | ₹50L-₹2Cr funding, network of 500+ angels, Series A support | Focus on India-specific solutions for underserved rural or climate-tech markets. |

Entrepreneur First - Bengaluru, offline | Generalist, DeepTech, AI, Software | $12K grant plus $250K potential | $12K talent grant, co-founder matching, Singapore expansion pathway | Pitch as solo tech founder seeking matching for Day Zero development. |

Founder Institute - Global, hybrid/offline | Generalist across sectors; pre-seed to MVP | $800 per founder + 2% equity on graduation | 12-week program, global mentor bench, alumni network scaling, milestone-driven accountability | Demonstrate commitment and iteration speed within structured execution loops. |

Google for Startups - Virtual/BLR, hybrid | AI-first, LLMs, RAG, Autonomous AI | 0% equity dilution | $100K Cloud credits, Google product team mentorship, Gemini LLM access | Highlight AI/ML core features and technical scalability via Google Cloud. |

GSF Founders Academy - Gurugram, India, hybrid | Generalist; PMF and growth emphasis | $25K–$50K for 7–10% (terms vary by cohort) | 90-day structured program, practitioner mentors, investor sessions, track record of exits | Demonstrate shipping velocity and validation inside a tight ninety-day sprint. |

IIM Kozhikode LIVE BIP - Kozhikode, India, hybrid | Generalist: tech, deeptech, social impact, MSMEs | Grants/equity vary; fellowship grants up to ₹36L | 2-year incubation, subsidized workspace, IIMK faculty mentorship, India-focused investor access | Pitch as India base-builder with PoC readiness and academic backing. |

IIMA Ventures - Ahmedabad, India, hybrid | Frontier tech, deeptech, sustainability, commercial impact | $100K–$150K typical, 5–10% equity (deal-dependent) | Academic credibility, faculty access, operator mentorship, investor network, Demo Day, portfolio follow-on | Prove technical validation, IP research, and credible non-incremental commercialization paths. |

IIT Bombay Park - Mumbai, offline | DeepTech, Quantum, Advanced Materials | Terms vary; shared post-selection | ₹25L-₹1Cr funding, direct ₹100Cr VC fund pathway, R&D facility access | Highlight quantum or advanced materials research to access specific R&D funds. |

IIT Madras Inc. - Chennai, offline | DeepTech, Hardware, AI, Biotech | Terms vary; shared post-selection | ₹20L-₹1.5Cr funding, 25+ Centres of Excellence access, deep-tech exit support | Showcase technical validation for energy or semiconductors with deep-tech support. |

India Accelerator - Gurugram/pan-India, hybrid | Generalist: AI, fintech, SaaS, enterprise, consumer, sustainability, EV, proptech, deeptech | $30K–$1M via AIFs; 5–12% equity (fund-dependent) | Multiple funds, iAngels mentor base, co-working/IA Spaces, follow-on support, global partnerships | Win with early traction, unit economics, and founder unfair advantages. |

IndieBio - San Francisco/New York, USA, offline | Biotech, life sciences, synbio, climate-bio | Equity/investment varies; SOSV-backed | Lab access, biotech investor network, regulatory/operator bench, deep-tech market knowledge | Frame pitch as scientific memo covering data, IP, and regulations. |

JioGenNext - India, residential/hybrid | B2B across sectors: commerce, agri, education, healthcare, fintech, media, telecom, AI/ML, IoT, AR/VR | $250K–$1M; equity negotiable; program + PoC commitment | Pilot inside Reliance/Jio ecosystem, distribution leverage, partner network, cohort-based acceleration | Pitch like enterprise BD with pilot-ready solutions and success metrics. |

Kstart (Kalaari) - Bengaluru, offline | Multi-sector, FinTech, SaaS, Tech Services | Equity dilution for pre-seed funding | ₹50L funding, direct pipeline to $300M funds, Kalaari partner mentorship | Position as institutional candidate for Fintech or SaaS infrastructure venture funds. |

Lightspeed India Ascends - Bangalore, India, hybrid | Deeptech: robotics, quantum, space, energy, AI, biotech (founders under-25) | Terms vary; winners: $200K–$3M seed | $100K partner credits (Anthropic, Groq, Google Cloud, AWS), 2-day intensive, partner mentorship, investor access | Lead with R&D defensibility, prototypes, and clear moats for moonshots. |

Lowercarbon Earth Accelerator - Asia-Pacific, hybrid | Climate tech: circular economy, climate data, clean energy/storage, water infra, sustainable agri, plastics/recycling | Mostly non-dilutive (grants/partner support); some tracks 0–5% equity (case-by-case) | 9-week bootcamp, 100+ mentors, UNEP partnership, investor showcase, strong climate VC access, women-led focus | Lead with quantified climate impact, India validation, and policy fit. |

MassChallenge Switzerland - Lausanne, Switzerland, hybrid | Climate, health, sustainable industry, enterprise innovation (cohort varies) | 0% equity (MassChallenge model) | Accelerator support, partner access, global bootcamp, investor access | Present EU entry thesis with compliance pathways and customer targets. |

MeitY Startup Hub - Pan-India, offline | AI, Electronics, Cybersecurity, Hardware | 0% equity for non-dilutive support | ₹100Cr AI fund access, government pilot opportunities, physical innovation hubs | Align with government mandates in language tech for zero-equity funding. |

NASSCOM 10,000 - Pan-India, offline | DeepTech, SaaS, AI, IoT, Biotech | Ecosystem support for seed startups | ₹15L-₹50L funding, mentorship from major CTOs, tax credit access | Present Indian-built tech for global markets seeking major industry mentorship. |

NSRCEL (IIM-B) - Bengaluru, offline | SaaS, DeepTech, HealthTech, Social Impact | 8-12% equity for ₹25L-₹75L | ₹25L-₹75L funding, IIM-B faculty mentorship, $100M+ follow-on fund access | Prove team depth and founder background for high TAM sectors. |

Orbit Startups - Asia-focused, global reach, hybrid | Emerging markets: health, climate, education, finance, logistics | Some tracks: $100K initial investment (terms track-dependent) | 4-month acceleration, follow-on ecosystem access, investor network, SOSV backing | Frame India as scale engine with one exportable global wedge. |

Plug and Play India - Bengaluru, hybrid | FinTech, InsurTech, Mobility, Supply Chain | Terms vary by corporate pilot | ₹20L-₹1Cr range, 400+ corporate partners, fast corporate sales cycles | Showcase B2B sales readiness to secure fast corporate pilot cycles. |

Rainmatter Capital - Bengaluru, offline | FinTech, Health, Storytelling, Impact | Patient capital; lightweight governance | ₹1Cr-₹10Cr funding, Zerodha API access, no board seat requirement | Align with financial health thesis for patient, no-pressure capital. |

Seedcamp - London, online | Generalist, SaaS, FinTech, Global | 6-8% equity for €100K | €100K funding, European corporate access, 1,000+ mentor network | Present India-origin team with clear European expansion and partnership goals. |

Sequoia Surge - Mumbai/BLR, offline | Generalist, SaaS, AI, FinTech, Consumer | 6-10% equity plus uncapped MFN | 1M−3M funding, partner backing, Demo Day to 150+ institutional investors | Lead with strong MRR, unit economics, and portfolio founder intros. |

She Capital - Mumbai, offline | Generalist, Women-led only | Equity investment for growth capital | ₹3-5Cr funding, direct board seat, 200+ female founder network | Apply as majority women-founded team focusing on growth-stage metrics. |

SoGal Ventures - Global, online | Generalist, Women-founded teams | Terms vary; shared post-selection | VC funding access, strategic mentorship, brand visibility | Highlight women-founder angle for strategic visibility in impact-focused funds. |

Startup India (SISFS) - Pan-India, offline | Generalist, Technology, Innovation, Scaling | 0% equity for government grant | ₹20L-₹50L funding, no collateral required, government-backed credibility | Secure DPIIT recognition first, then submit detailed innovation roadmap. |

Startupbootcamp Food & AgriTech - Amsterdam, NL, hybrid | FoodTech, AgriTech, sustainability: alt proteins, precision ag, food waste, packaging | 6–8% equity for €25K (program-dependent) | €25K cash + credits, 100+ mentors, corporate pilots, global Demo Day, large alumni base | Win with cross-border sustainability, revenue proof, and scalable wedges. |

T-Hub - Hyderabad, offline | IoT, AI, Blockchain, Hardware, SaaS | Terms vary; shared post-selection | ₹25L-₹1Cr funding, physical incubation, corporate pilot access with Tech Mahindra | Pitch deep-tech solutions as PoCs for local corporate ecosystems. |

Techstars Global - Global, online | Generalist, Remote-first, Sector tracks | 6% equity for 120K−300K | 100K−300K funding, US visa support, lifetime alumni network | Apply to remote tracks outlining scalability and US visa needs. |

Techstars India - Bengaluru, offline | AI/ML, FinTech, Sustainability, ClimateOps | 6% equity for $120K | $120K funding, lifetime mentor network, corporate partnerships with AWS and Stripe | Focus on UPI rails or vision tech for global access. |

The Foundery - India, residential (location TBA) | Generalist; founder quality and execution over sector | Co-founder factory model; participants retain up to 25% equity in startups created | 90-day residential program, seed funding up to ₹4Cr for selected ventures, operator mentorship, Demo Day | Apply for intense build sprints; position as high-stamina builder. |

The Plug - Virtual/Physical, hybrid | Generalist, Consumer, Technology | Low dilution for pre-seed | ₹10L-₹1Cr funding, emerging investor network, unit economics workshops | Emphasize unit economics and hiring proof for consumer tech startups. |

TiE Accelerators - Pan-India, offline | Generalist, B2B Tech, SaaS | Network access and investment terms | ₹15L-₹75L funding, 15,000+ member network, TiE Angel access | Leverage regional chapters for B2B networking and early angel capital. |

Venture Catalysts - Mumbai/pan-India, hybrid | Generalist: B2B SaaS, fintech, consumer, deeptech, health, edtech | Angel syndication; $50K–$150K typical cheques; 5–15% equity (deal-dependent) | Large angel + mentor network, syndication and co-invest, pitch days, follow-on support, fundraising governance help | Pitch angels on traction signals and crisp execution plans. |

Villgro Innovations - Chennai, offline | Social Enterprise, Health, Energy, Agri | 0-10% equity for grant capital | ₹10L-₹50L grants, NGO pilot partnerships, prototype development support | Define measurable rural impact and pitch prototype pilots to NGOs. |

Y Combinator - SF/Global, online | Generalist, SaaS, AI, FinTech, Health | 7% equity for 500K−750K | 500K−750K funding, 500+ mentor investors, alumni network of 41,000+ | Show high MoM growth and obsessively focus on problem execution. |

The Application Playbook and Final Checklist

Before you apply, treat this like a fundraising sprint. Your goal is to reduce uncertainty for the selection committee in under 5 minutes. You must answer: What do you build? Who buys it? Do they love it? Why will you win?

Use the How to Approach column above as your narrative anchor.

Final Checklist (The "Green Light" Audit):

✅ Traction: MVP is live with measurable progress (DAU, MRR, or Retention).

✅ Team: 2-3 co-founders with clear roles (e.g., Hacker + Hustler).

✅ Deck: 10-15 slides max. (Problem, Solution, Market, Traction, Team, Ask).

✅ Demo: 3-minute video of the product being used (no slides, no marketing fluff).

✅ Validation: At least 1-2 paying customers OR a strong Letter of Intent (LOI).

✅ Digital Presence: Founders have updated LinkedIn profiles with 500+ connections.

✅ References: 2 technical advisors or industry experts ready to vouch for you.

✅ Global Ops: Valid Passport + Visa readiness confirmed (for US programs).

Turn Your Application into a Fundraising Asset

Getting into an accelerator is a milestone, not the destination. Use the application process to refine your pitch and tighten your metrics. And while you wait for the interview call, keep building momentum. List your startup on Backrr to start getting discovered by Angels and VCs who might write your first check before Demo Day even arrives.